How to Make a Will Template That’s Legally Sound: A Comprehensive Guide

Planning for the future is crucial, and one of the most important steps you can take is creating a will. A will, also known as a last will and testament, ensures your assets are distributed according to your wishes after your passing. While the thought of drafting a will can seem daunting, creating a legally sound will template can be simpler than you think. This guide provides a comprehensive overview of how to create a will template that meets legal requirements and protects your legacy.

Understanding the Importance of a Will

Before diving into the process, it’s vital to understand why a will is so important. Without a will, your assets will be distributed according to your state’s intestacy laws. This process can be complex, time-consuming, and may not reflect your desired distribution. A properly executed will allows you to:

- Specify beneficiaries: Decide who will inherit your assets.

- Name an executor: Appoint someone you trust to manage the distribution of your estate.

- Designate guardians for minor children: Ensure your children are cared for by individuals you choose.

- Control the distribution of assets: Dictate how and when your assets are distributed.

- Minimize potential disputes: A clear will can reduce the likelihood of family conflicts.

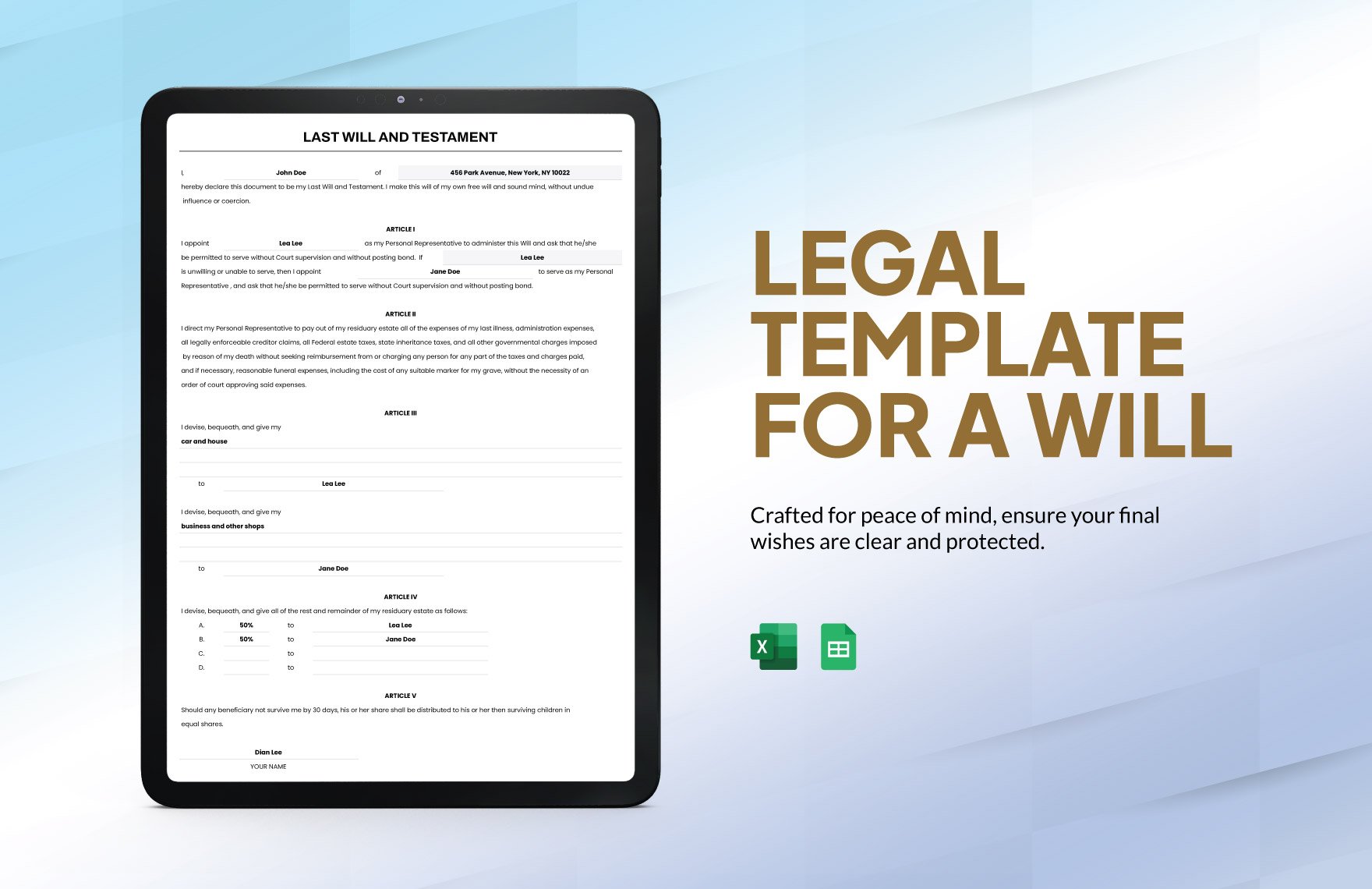

Essential Components of a Legally Sound Will Template

To ensure your will is legally valid, it must include specific components. These components can be incorporated into a template to save time and effort.

Heading and Introductory Clause:

- Clearly state the document is a “Last Will and Testament.”

- Include your full legal name, address, and a statement of your sound mind and body.

Declaration of Family:

- Identify your spouse (if applicable).

- List your children, including their full names and dates of birth. This is crucial, even if you choose to exclude a child from inheriting.

Appointment of an Executor:

- Name the executor (the person responsible for carrying out your will).

- Include a backup executor in case the first is unable or unwilling to serve.

- Provide the executor’s full name, address, and contact information.

Asset Distribution (Beneficiary Designations):

- Clearly state who will inherit your assets (real estate, bank accounts, investments, personal property, etc.).

- Specify the percentage or specific items each beneficiary will receive.

- Provide the full names and addresses of all beneficiaries.

- Consider adding a “survivorship clause” to address what happens if a beneficiary dies before you.

Guardian Designation (for Minor Children):

- If you have minor children, name a guardian to care for them.

- Include the guardian’s full name, address, and contact information.

- Consider naming an alternate guardian.

Specific Bequests (if applicable):

- Detail specific items (e.g., jewelry, artwork) you wish to give to specific individuals.

Residuary Clause:

- This clause addresses any remaining assets not specifically mentioned in the will. It directs how the “residue” (the rest) of your estate will be distributed.

Signing and Witnessing:

- Your Signature: You must sign the will.

- Witnesses: Most states require two or more witnesses (adults who are not beneficiaries) to witness your signature and sign the will themselves.

- Notarization (Optional, but recommended): Some states recommend or require notarization of the will. This can help authenticate the document and streamline the probate process.

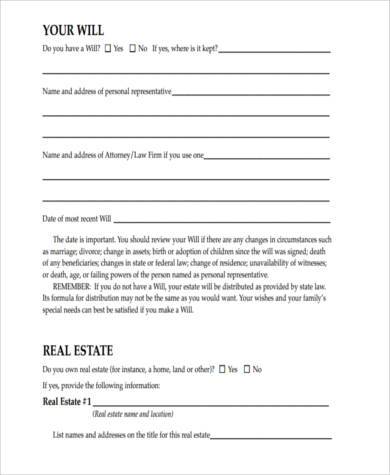

Creating Your Will Template: Steps and Considerations

Here’s a step-by-step guide to creating a legally sound will template:

- Research Your State’s Laws: Will laws vary significantly by state. Understanding your state’s specific requirements (e.g., witness requirements, notarization rules) is paramount.

- Choose a Template Source:

- Online Templates: Numerous online resources offer will templates. Choose reputable sources that are regularly updated and compliant with legal standards.

- Legal Professionals: Consider consulting with an attorney to create a customized will template that addresses your specific needs and circumstances.

- Personalize the Template:

- Carefully fill in the required information, including your name, beneficiaries’ names, asset details, and executor information.

- Be precise and unambiguous in your language.

- Consider adding a “no-contest” clause to discourage legal challenges to your will.

- Review and Revise:

- Thoroughly review the completed template for accuracy and completeness.

- Have a trusted friend or family member review the document for clarity.

- Execute the Will:

- Sign and Witness: In the presence of the required witnesses, sign your will and have the witnesses sign it, too.

- Notarize (if applicable): If your state requires or recommends notarization, have the will notarized by a qualified notary public.

- Store Your Will Safely:

- Keep the original will in a safe, accessible location (e.g., a fireproof safe, a safe deposit box).

- Inform your executor of the will’s location.

- Consider providing copies to trusted individuals.

- Regularly Review and Update:

- Life changes (marriage, divorce, birth or death of a child) necessitate updating your will.

- Review your will every few years to ensure it still reflects your wishes and complies with current laws.

Key Considerations for Legal Soundness

- Clarity and Precision: Use clear, concise language to avoid ambiguity.

- Legal Capacity: Ensure you are of sound mind and understand the document you are signing.

- Witness Qualifications: Witnesses must be of legal age and not beneficiaries of the will (in most jurisdictions).

- Proper Execution: Strictly adhere to your state’s requirements for signing and witnessing.

- Avoid Handwritten Changes: Make any changes to the will through a formal amendment (codicil).

- Consider a Codicil: If you need to make minor changes, a codicil can modify your existing will without requiring a complete rewrite.

Conclusion: Protecting Your Legacy

Creating a legally sound will template is a vital step in estate planning. By following these guidelines and understanding the essential components, you can create a will that accurately reflects your wishes and protects your loved ones. While online templates can be a good starting point, consulting with an attorney can ensure your will is tailored to your specific needs and fully compliant with your state’s laws. Taking the time to create and update your will is a gift of peace of mind, allowing you to face the future with confidence.

FAQs

Can I create a will entirely online? Yes, you can create a will using online templates, but ensure the platform is reputable and complies with your state’s laws. Be sure to properly execute the will (sign and witness) as required by law.

Do I need a lawyer to create a will? While not legally required, consulting with an attorney is highly recommended, especially if your estate is complex or you have unique circumstances. An attorney can provide personalized advice and ensure your will is legally sound.

What happens if I don’t have a will? If you die without a will (intestate), your assets will be distributed according to your state’s intestacy laws. This process may not align with your wishes and can be more complex and costly.

How often should I update my will? You should review and update your will regularly, especially after major life events such as marriage, divorce, the birth or death of a child, or a significant change in your financial circumstances. Every few years is a good practice.

What is the difference between a will and a living trust? A will dictates how your assets are distributed after your death. A living trust, on the other hand, is a legal arrangement that holds your assets and can dictate how they are managed during your lifetime and after your death. Trusts can often avoid probate, providing additional benefits.