The Free 1099 Pay Stub Template That Will Save You Time

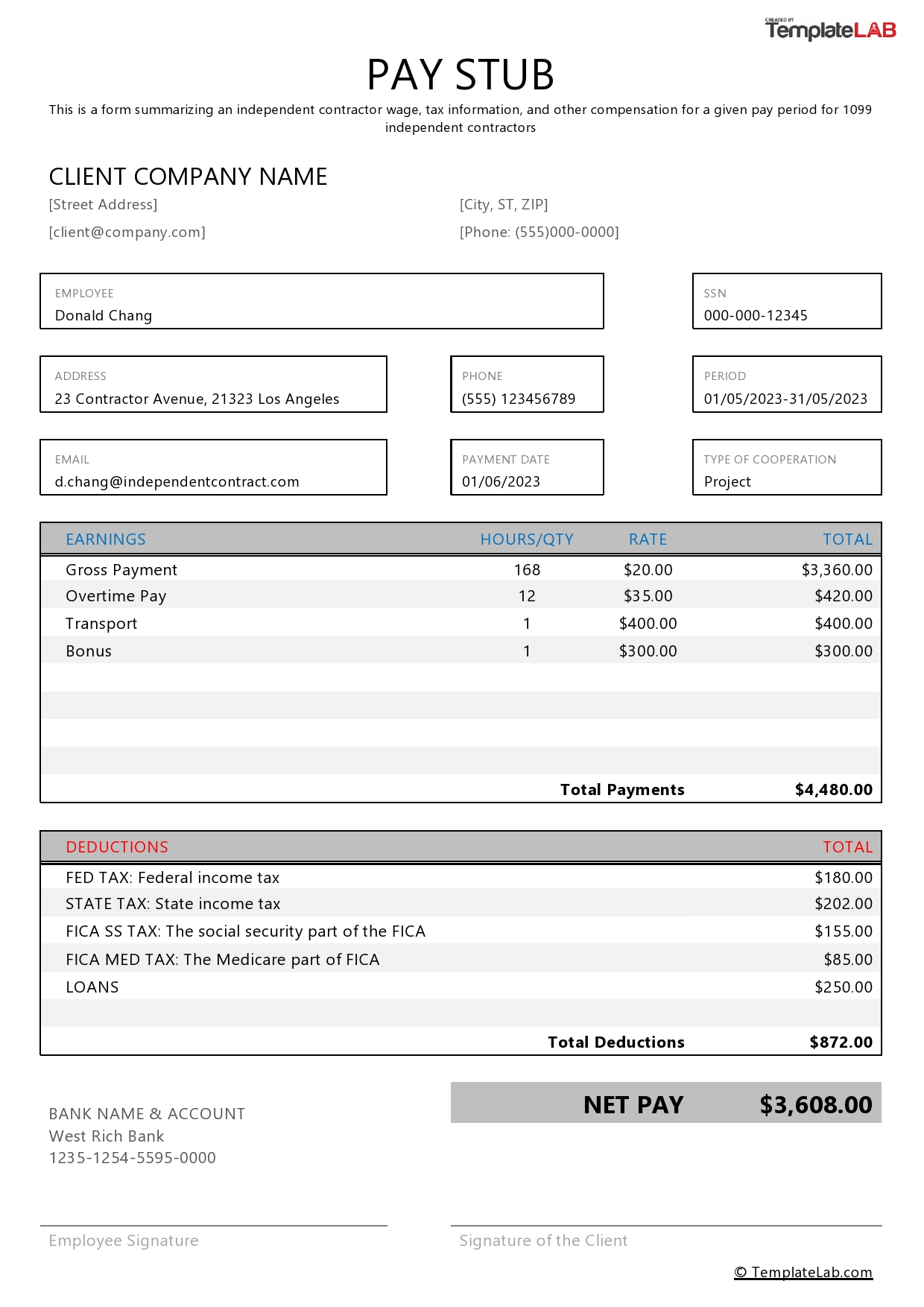

Are you an independent contractor, freelancer, or self-employed individual juggling multiple clients and projects? Keeping track of your income and expenses can feel like a constant battle, especially when tax season rolls around. One essential document you need to manage your finances effectively is the 1099 pay stub. But creating these stubs from scratch can be time-consuming. That’s where a free 1099 pay stub template comes in. This article will delve into the benefits of using a free template and how it can streamline your financial organization, ultimately saving you valuable time and stress.

Understanding the Importance of a 1099 Pay Stub

Before diving into the templates, let’s clarify why a 1099 pay stub is so crucial. As a non-employee, you are responsible for paying your own taxes. The 1099 pay stub serves as a record of payments you’ve received from clients during the tax year. This document helps you:

- Accurately Report Income: It provides a clear breakdown of your earnings, ensuring you report the correct amount to the IRS.

- Track Payments: It allows you to easily reconcile payments received with invoices sent, minimizing the risk of errors or missed income.

- Prepare for Tax Season: By having a consolidated record of your income, you are better prepared when it’s time to file your taxes.

- Maintain Professionalism: Providing a professional-looking pay stub to your clients (if you choose to) reinforces your business’s credibility.

Benefits of Using a Free 1099 Pay Stub Template

Using a free 1099 pay stub template offers several advantages, making financial management more manageable:

- Time Savings: No more creating stubs from scratch! Templates provide a pre-formatted structure, saving you significant time.

- Reduced Errors: Templates eliminate the risk of manual calculation errors, ensuring accuracy in your income tracking.

- Professionalism: Templates often have a professional appearance, making them suitable for sharing with clients (optional).

- Accessibility: Many free templates are readily available online in various formats (e.g., Excel, Google Sheets, PDF), offering flexibility and ease of use.

- Cost-Effectiveness: Free templates are an excellent resource for independent contractors, allowing you to save money on expensive accounting software.

Finding and Using a Free 1099 Pay Stub Template

Numerous websites and software platforms offer free 1099 pay stub templates. Here’s a general guide on how to find and use them:

- Search Online: Conduct a simple search using terms like “free 1099 pay stub template Excel,” “free 1099 pay stub template Google Sheets,” or “free 1099 pay stub PDF.”

- Choose a Format: Select a template in a format you are comfortable with and can easily edit (e.g., Excel, Google Sheets).

- Download and Customize: Download the template and customize it with your information, including:

- Your Name and Business Name (if applicable)

- Your Address and Contact Information

- Client’s Name and Contact Information

- Payment Date

- Payment Amount

- Description of Services Provided (optional, but recommended for clarity)

- Save and Print (or Save Electronically): Save the completed pay stub for your records. You can print it for your files or save it electronically for digital record-keeping.

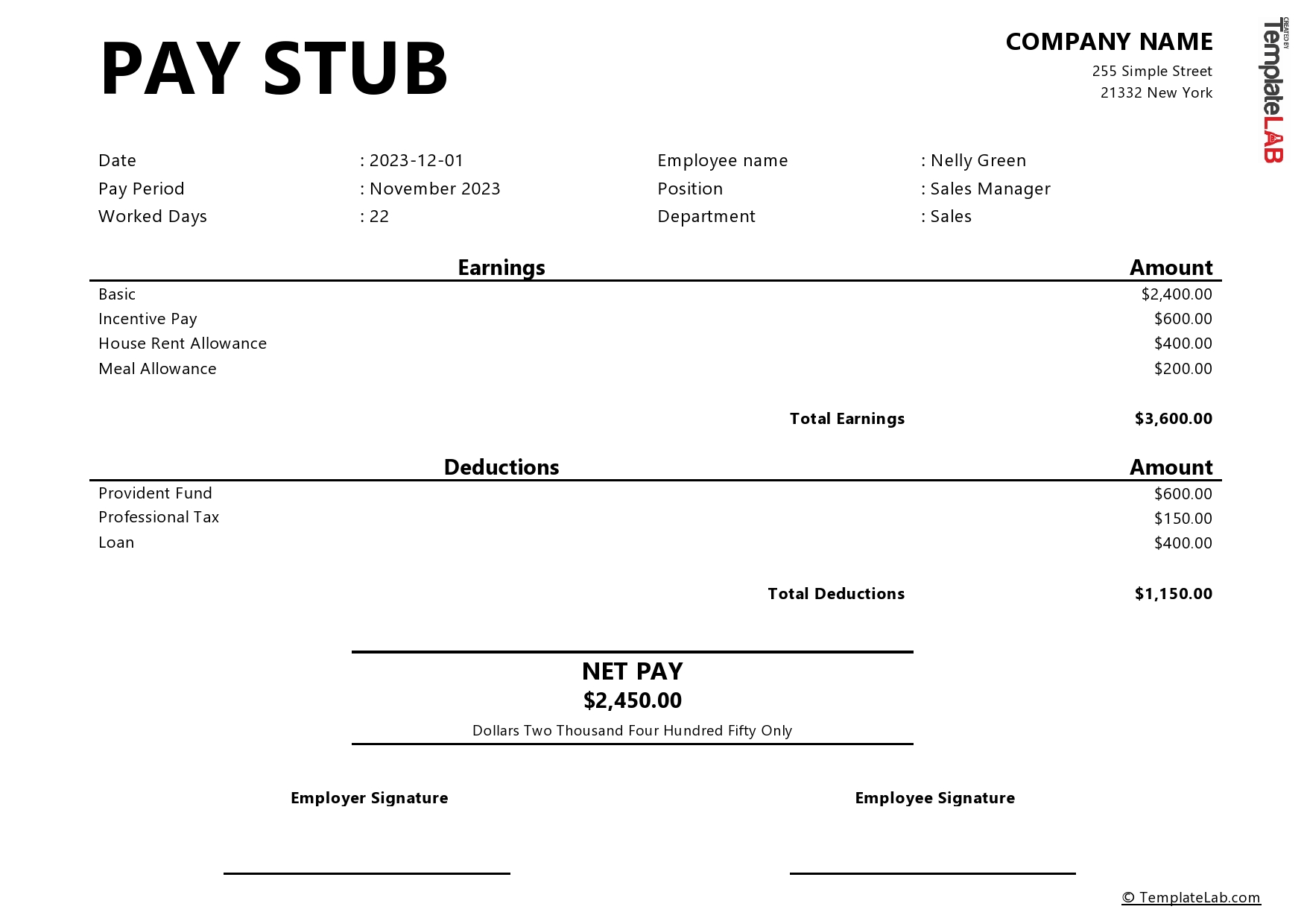

Key Elements to Include in Your 1099 Pay Stub

While the specific design of a template may vary, ensure your 1099 pay stub includes the following essential details:

- Payee Information: Your name, business name (if applicable), address, and contact information.

- Payer Information: The client’s name, address, and contact information.

- Payment Date: The date the payment was received.

- Payment Amount: The total amount received for the services provided.

- Description of Services: A brief description of the work performed for that payment (e.g., “Website Design,” “Freelance Writing”). This helps clarify what the payment represents.

- Invoice Number (Optional): Including the invoice number can help you keep track of your invoices and payments.

- Total Income to Date (Optional, but Recommended): Include a running total of income received from the client during the tax year. This provides a quick snapshot of your earnings.

Best Practices for Using a 1099 Pay Stub Template

To maximize the efficiency of your 1099 pay stub template, consider these best practices:

- Maintain a Consistent System: Use the template consistently for every payment to create a reliable record.

- Back Up Your Files: Regularly back up your template files to prevent data loss.

- Review Regularly: Periodically review your pay stubs to ensure accuracy and identify any discrepancies.

- Store Securely: Keep your pay stubs in a secure location, either electronically or physically.

- Consider Software Integration (If Needed): As your business grows, you might consider integrating your template with accounting software for more advanced features like expense tracking and tax preparation.

Conclusion: Embrace Efficiency with a Free 1099 Pay Stub Template

Managing your finances as an independent contractor doesn’t have to be complicated. By utilizing a free 1099 pay stub template, you can streamline your income tracking, save time, and reduce the stress associated with tax season. Embrace the convenience and accuracy offered by these templates, and focus on what you do best – providing your valuable services to your clients. Start today and experience the benefits of organized financial management!

FAQs

1. Where can I find a free 1099 pay stub template?

You can find free 1099 pay stub templates on various websites, including:

- Microsoft Office (for Excel templates)

- Google Sheets (search within the template gallery)

- Small business resource websites

- Accounting software providers (some offer free templates as a promotional tool)

2. Is a 1099 pay stub the same as a 1099-NEC form?

No, they are different. The 1099 pay stub is a record of payments you receive from clients. The 1099-NEC form (or 1099-MISC in some cases) is a form issued by your client to the IRS and to you, reporting the total payments they made to you during the tax year. The 1099-NEC form is what you use to report your income on your tax return.

3. Is it legally required to provide a 1099 pay stub to my clients?

No, it’s not legally required. You are responsible for tracking your income and reporting it to the IRS. However, providing a 1099 pay stub to your clients (if you choose to) can be a professional courtesy and can help them with their record-keeping, especially if they are a business and need to deduct your payments as a business expense.

4. Can I use a 1099 pay stub template for my business expenses?

No, a 1099 pay stub template is specifically designed for recording income received. You will need to track your business expenses separately, typically using a spreadsheet, accounting software, or other expense tracking tools.

5. What if I receive payments through a payment processing platform (like PayPal or Stripe)?

Even if you use a payment processing platform, it’s still a good idea to create a 1099 pay stub for each payment. Payment platforms provide transaction records, but a pay stub helps you categorize and organize your income from each client, making reconciliation and tax preparation much easier.