Decoding the 3949-A: What You Need to Know About This Printable Form

The world of tax and financial reporting can feel like navigating a complex maze. Among the many forms and documents you might encounter, the IRS Form 3949-A often surfaces. While it might not directly impact individual taxpayers, understanding the purpose and function of this form is crucial, especially if you are potentially involved in a situation that could trigger its use. This article provides a comprehensive overview of Form 3949-A, its purpose, who uses it, and what it signifies.

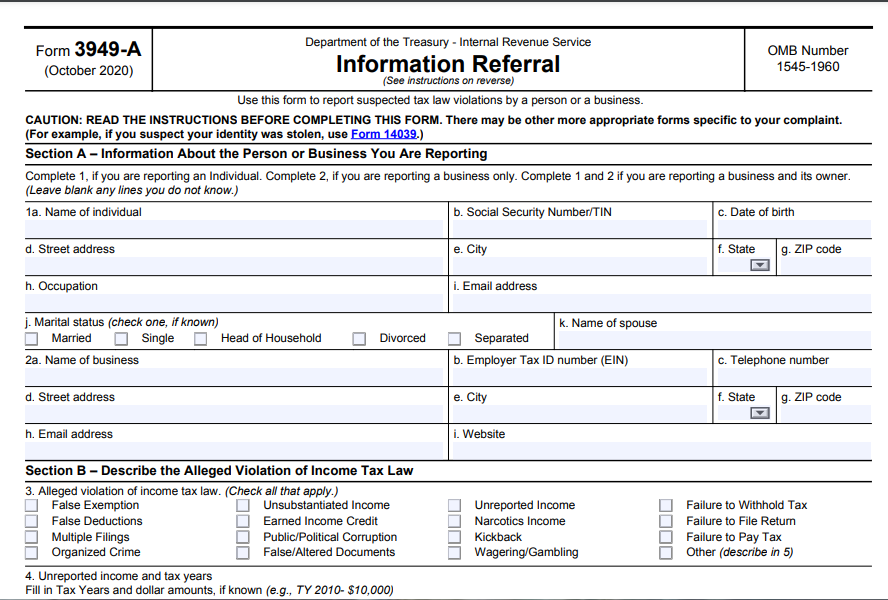

What is IRS Form 3949-A?

IRS Form 3949-A, officially titled “Information Referral,” is used by the Internal Revenue Service (IRS) to report potential tax law violations. Think of it as a tool for individuals to alert the IRS to activities that might warrant further investigation. It’s a vital part of the IRS’s efforts to maintain tax compliance and ensure fairness within the system.

Who Uses Form 3949-A?

Form 3949-A isn’t something individuals typically use to file their taxes. Instead, it’s primarily used by:

- Individuals: Anyone can fill out and submit Form 3949-A to report potential tax violations they observe. This might include suspected tax evasion, fraud, or other non-compliance issues.

- Businesses: Businesses can also utilize this form to report potential tax violations.

- IRS Employees: While not a primary user, IRS employees may also use this form to document and refer information they receive.

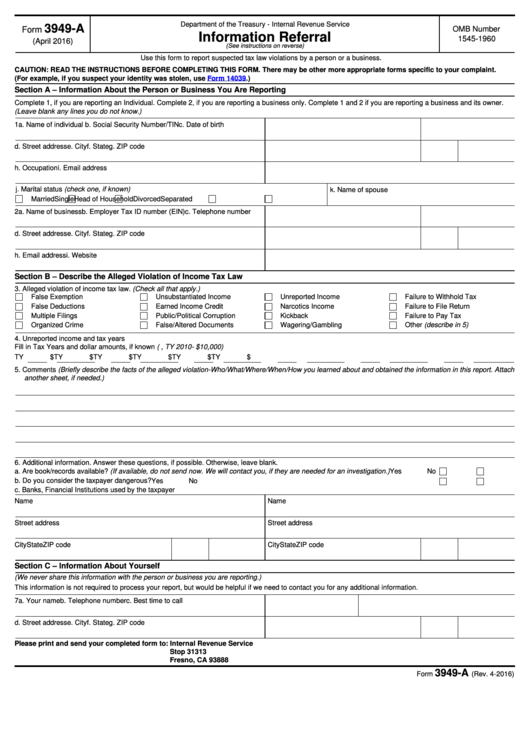

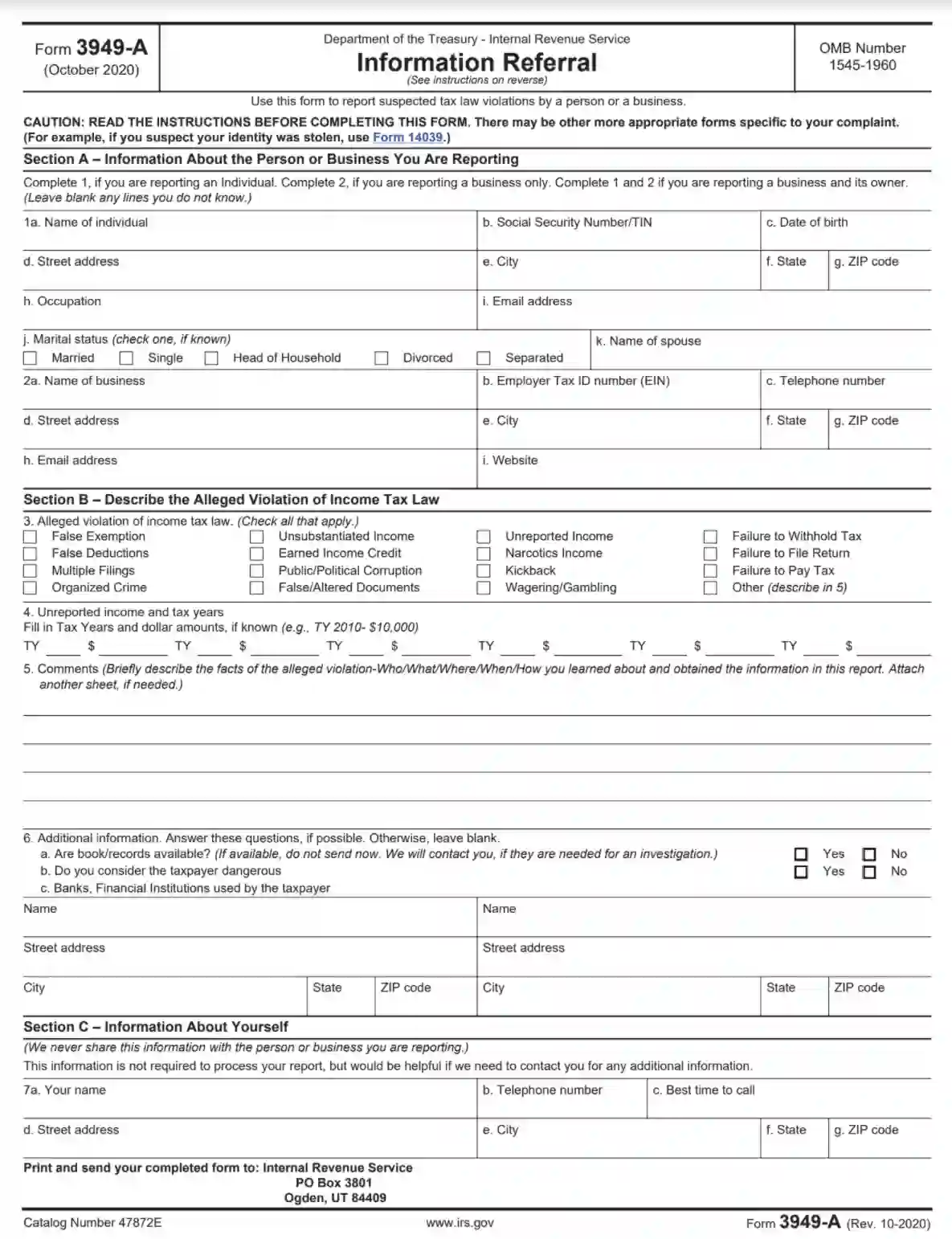

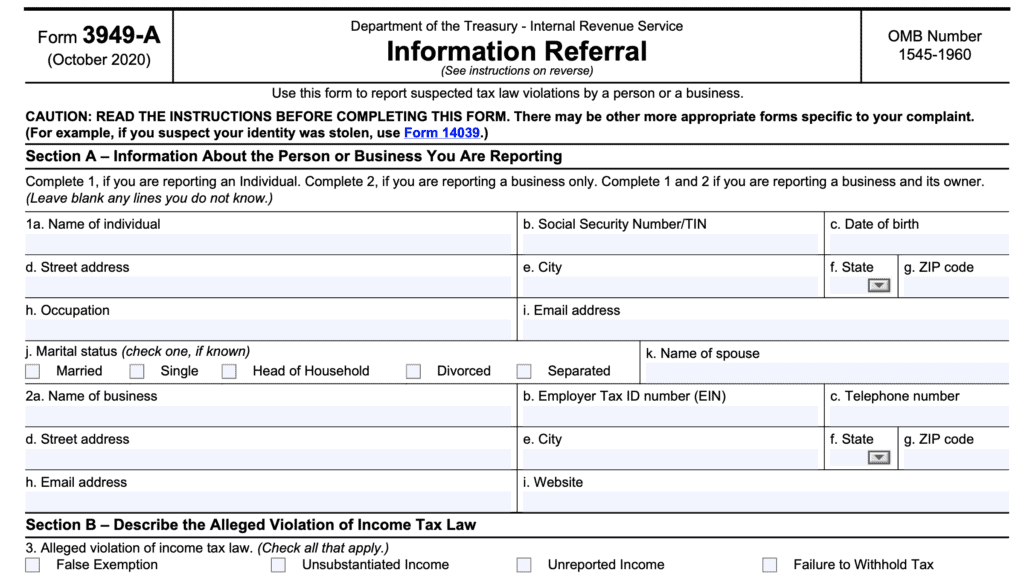

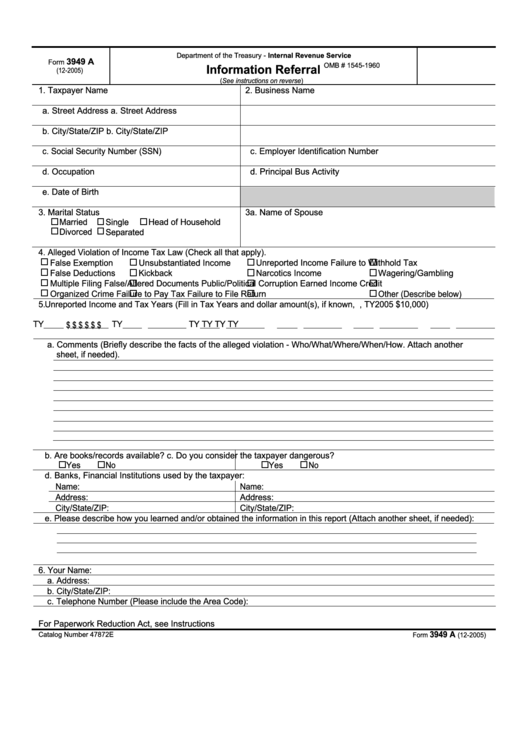

What Information is Reported on Form 3949-A?

The information requested on Form 3949-A is designed to provide the IRS with sufficient details to evaluate the potential for tax law violations. The form typically requests the following:

- Subject of the Report: This includes the individual or entity suspected of the violation. You’ll need to provide their name, address, and, if available, their Social Security Number (SSN) or Employer Identification Number (EIN).

- Description of the Violation: This is the most critical part. You need to clearly and concisely describe the suspected tax law violation. Examples include:

- Failure to report income

- Filing false deductions

- Claiming improper credits

- Other potential tax fraud or evasion

- Supporting Documentation: If possible, you should include any supporting documentation that helps substantiate your claims. This could include:

- Bank statements

- Invoices

- Receipts

- Correspondence

- Reporter Information: You are required to provide your own contact information, including your name, address, and phone number. Important Note: While you are required to provide this information, the IRS will keep your identity confidential.

Why is Form 3949-A Important?

Form 3949-A plays a crucial role in the IRS’s efforts to:

- Detect Tax Evasion and Fraud: By providing a mechanism for reporting suspected violations, the form helps the IRS identify and investigate potential instances of tax non-compliance.

- Ensure Fair Taxation: Reporting suspected tax avoidance helps maintain a level playing field for all taxpayers.

- Protect Tax Revenue: By uncovering and addressing tax violations, the IRS can recover lost tax revenue and deter future non-compliance.

How is Form 3949-A Used by the IRS?

Once the IRS receives Form 3949-A, it’s reviewed by IRS personnel. The IRS will then assess the information provided and determine whether further investigation is warranted. This investigation might involve:

- Reviewing Tax Returns: The IRS may examine the tax returns of the individual or entity named in the report.

- Contacting the Subject: The IRS might contact the subject for clarification or to request additional information.

- Auditing: The IRS could initiate an audit of the subject’s financial records.

- Criminal Investigation: In more severe cases, the IRS may refer the matter to its Criminal Investigation division.

Where Can You Find and Submit Form 3949-A?

You can download a printable version of Form 3949-A directly from the IRS website (IRS.gov). The form is readily available in PDF format.

- Submission: Once completed, the form can be mailed to the address specified on the form itself. The address may vary depending on the location of the subject of the report.

Key Considerations Before Submitting Form 3949-A

- Accuracy: Ensure all information provided is accurate and truthful.

- Completeness: Provide as much detail and supporting documentation as possible.

- Confidentiality: The IRS is committed to protecting the identity of the person submitting the report.

- No Guarantee of Action: Submitting Form 3949-A does not guarantee that the IRS will take action. The IRS will evaluate the information and decide whether to investigate further.

Conclusion

IRS Form 3949-A is a vital tool in the IRS’s enforcement efforts. By understanding its purpose, the information it requires, and how it’s used, you can be better informed about the process of reporting potential tax violations. While this form is not for general tax filing purposes, knowing its function can be helpful in various situations.

Frequently Asked Questions (FAQs)

Is my identity kept confidential if I submit Form 3949-A?

Yes, the IRS is committed to protecting the confidentiality of individuals who submit Form 3949-A. However, the IRS may be required to disclose your identity if ordered by a court.

What happens after I submit Form 3949-A?

The IRS will review the information you provide and determine whether further investigation is warranted. They may review tax returns, contact the subject of the report, or initiate an audit.

Can I submit Form 3949-A anonymously?

No, you must provide your contact information on Form 3949-A. However, the IRS will keep your identity confidential.

How long does the IRS take to respond to a Form 3949-A submission?

There is no set timeframe for the IRS to respond. The time it takes to process a referral depends on the complexity of the case and the IRS’s workload.

Should I consult a tax professional before submitting Form 3949-A?

While not mandatory, consulting a tax professional can be beneficial, especially if you are unsure about the tax implications of the suspected violation or are concerned about the accuracy of the information you are providing.